Ask For A Quick Quote

We will contact you within 1 working day, please pay attention to the email with the suffix “@fsdym.com”.

We will contact you within 1 working day, please pay attention to the email with the suffix “@fsdym.com”.

The dental industry in Indonesia is in a golden period of rapid growth, with strong market demand, substantial policy support, and profound development potential. DYM Medical, leveraging its own technical accumulation, product advantages, and compliance certifications, aligns highly with the development needs of the Indonesian dental market, possesses broad cooperative prospects, and is expected to achieve synergistic progress for both parties. The following analysis will be carried out from two aspects: industry prospects and corporate adaptability.

Prospects of the Dental Industry in Indonesia:

The dental market size continues to expand with strong growth momentum. As the most populous country in Southeast Asia with 270 million people, Indonesia’s dental market is accelerating its expansion. In 2024, the oral care market size reached 74.49 billion yen, and the dental services market was valued at 215 million US dollars. It is projected to grow at a compound annual rate of 6.08% to reach 315 million US dollars by 2030; moreover, authoritative institutions predict that Indonesia’s overall dental market size will grow from 3.7 billion US dollars in 2025 to 8.4 billion US dollars by 2031, with a high annual compound growth rate of 14.5%. The core driving factors include: economic growth driving the middle-class population to exceed 100 million, enhancing residents’ consumption capacity and increasing demand for high-quality oral medical services; aging population intensifying, leading to stable growth in demand for oral treatment and dental implants among the elderly; popularization of oral health awareness, extending from traditional treatment to preventive care and aesthetic restoration (such as dental implants and invisible orthodontics), continuously enriching consumption scenarios.

The Indonesian dental market, supported by policies and infrastructure gaps, creates market opportunities. The Indonesian government has included oral health in universal health insurance, and the ‘2024-2030 Oral Health Strategy’ explicitly includes dental implants and invisible orthodontics in the scope of medical insurance subsidies. The centralized procurement policy for dental implants has further driven down implant prices by 55%, directly stimulating a 30% increase in patient visits to private institutions. Meanwhile, market supply-demand imbalance is prominent: there is only 12 dentists per 100,000 people, medical resources in rural areas are extremely scarce, the demand gap for basic diagnostic equipment reaches 40%, and digital diagnostic equipment (such as AI oral scanners and digital implant systems) has an annual growth rate exceeding 30%, making equipment renewal urgent, thus providing a broad market space for dental equipment suppliers.

Favorable trends in the dental industry highlight diversified demand. The Indonesian dental industry is transforming from ‘passive treatment’ to ‘active prevention + personalized services’, with digitalization and intelligence as core trends, and online sales share has already exceeded 40%. In addition, dental tourism is emerging, attracting patients from neighboring countries with cost-effectiveness advantages, and demand for high-end oral treatment projects such as dental implants and orthodontics is growing significantly; private dental clinics are expanding rapidly, strongly demanding one-stop, high-cost-performance dental equipment procurement solutions, breaking the inefficiency of traditional decentralized procurement models.

The Adaptability of DYM’s One-Stop Dental Equipment to the Indonesian Dental Market: Complementary Advantages for Joint Development

DYM Medical’s 18 years of accumulation in the dental industry, product layout, and compliance credentials perfectly match the core needs of the Indonesian market, giving it a natural advantage for in-depth cooperation:

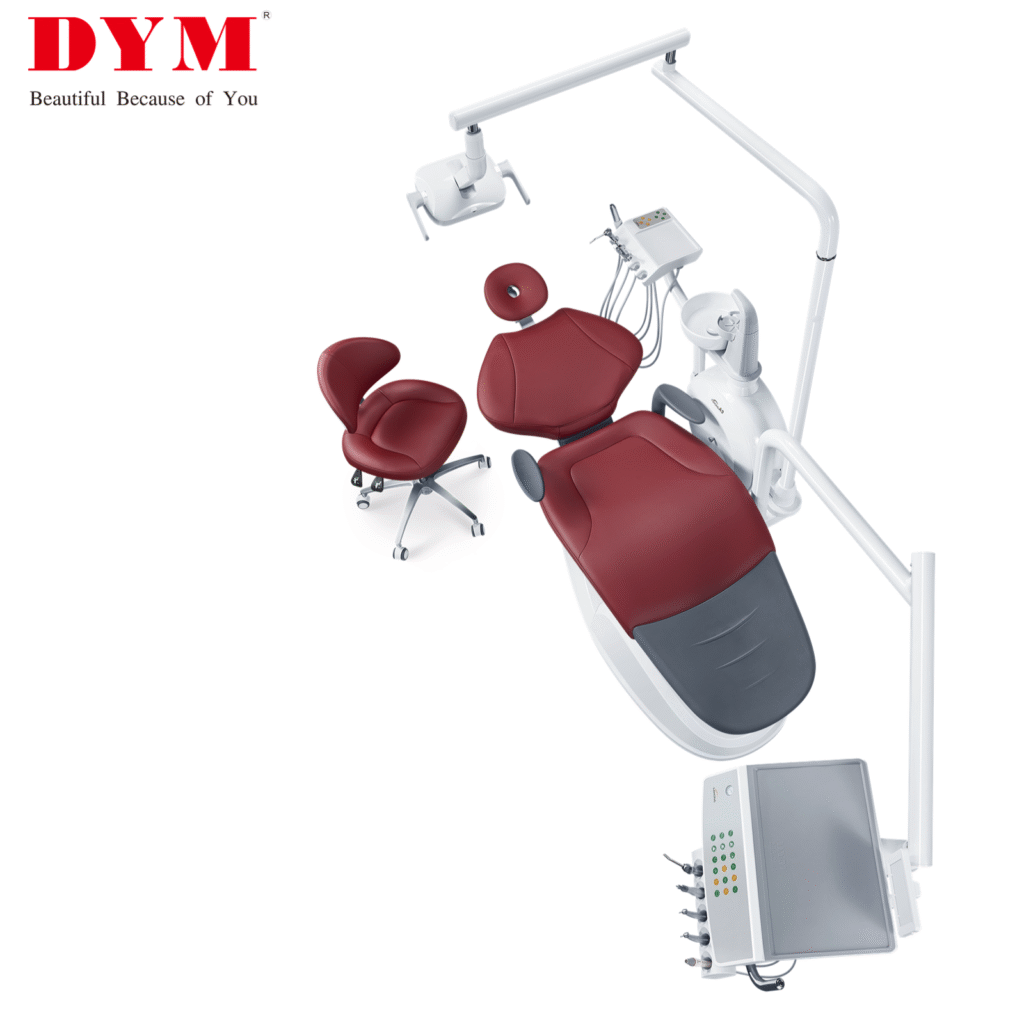

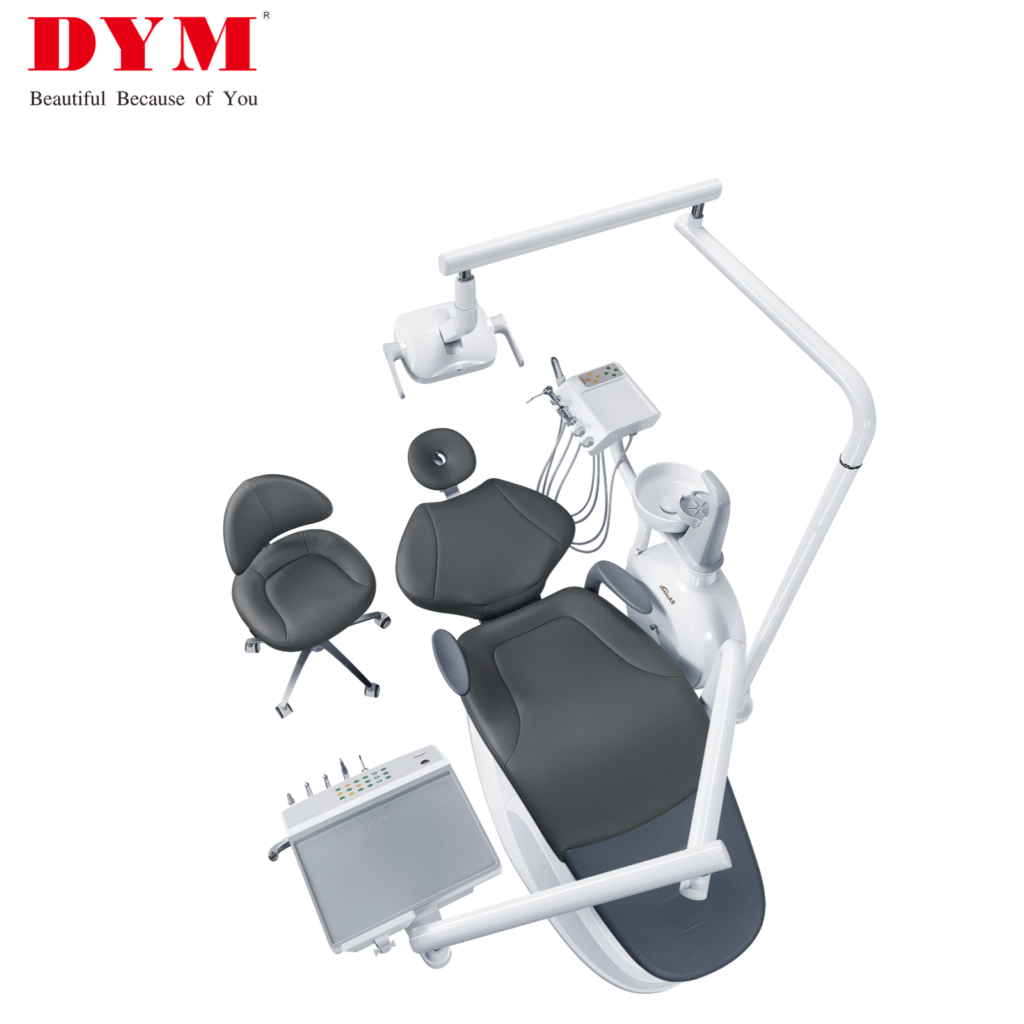

DYM Medical’s one-stop capability for dental equipment addresses the fragmented procurement pain points in the dental industry. Private dental clinics and chain oral institutions in Indonesia are seeking efficient equipment procurement models. DYM has developed a high-end one-stop service platform for dental equipment, covering all categories of dental products such as dental treatment units, air compressors, oral endoscopes, high-speed handpieces, negative pressure suction machines, and sewage treatment machines. This platform can directly replace the inefficient ‘multi-factory cooperation’ procurement method, helping local dealers improve procurement efficiency. It provides seamless services that are ‘time-saving, labor-saving, and worry-free’ for mid-to-high-end dental hospitals and clinics, perfectly meeting the demand for integrated equipment supply in the Indonesian dental market.

DYM Medical’s production and technical strength meet the market’s scale and quality requirements. DYM Medical has 32 dental equipment production lines and 60 CNC precision machining equipment, enabling large-scale production capacity. It can cope with the characteristics of Indonesia’s dental market, such as large equipment gaps and scattered demand, and quickly match the procurement needs of medical institutions at all levels in urban and rural areas. At the same time, its products cover the entire scenario from basic diagnosis and treatment to digital equipment, which can adapt to Indonesia’s diversified and personalized market needs ranging from basic treatment to high-end aesthetic restoration. Especially under the dual demand of basic equipment supplementation in rural areas and digital upgrading of urban institutions, its competitiveness is outstanding.

DYM Medical’s authoritative compliance certification breaks down market access barriers. Indonesia has strict compliance requirements for imported medical devices. DYM holds international authoritative certifications such as ISO9001, ISO13485 (core certification for medical device quality management system), and CE, fully complying with the ASEAN Medical Device Directive (AMDD) and registration requirements of Indonesia’s National Food and Drug Administration (BPOM). This allows it to smoothly enter the local market and reduce access risks. This advantage, combined with the industry foundation that Chinese dental equipment has already occupied 30% of the import market share in Indonesia, makes it easy to gain the trust of local institutions.

DYM Medical’s cooperative model is mature and meets the needs of expanding the dental market in Indonesia.

DYM adheres to the cooperation principle of ‘one agent per region’, focusing on win-win cooperation with partners. This model is well-suited to Indonesia’s vast territory and dispersed market characteristics. By cultivating local agent teams, it can quickly penetrate urban and rural markets and make up for the shortcomings of uneven distribution of local medical resources. Previously, DYM has reached strategic cooperation with regional partners in Indonesia, accumulating initial market resources and a good reputation, laying a foundation for subsequent in-depth expansion.

The Indonesian dental industry, driven by three core forces—demographic dividend, consumption upgrading, and policy support—is expected to maintain high growth in the next 5-10 years. There is a huge demand gap for oral equipment, especially basic treatment equipment and digital equipment, providing a rare development opportunity for Chinese dental equipment manufacturing enterprises. With 18 years of experience in dental equipment manufacturing as its foundation, DYM Medical, its one-stop supporting capabilities, large-scale production strength, international compliance certifications, and mature cooperation model, accurately matches the core pain points of the Indonesian dental market. It can not only meet the dental equipment procurement needs of local oral medical institutions but also achieve breakthroughs in its overseas business alongside the standardization and digitalization process of the Indonesian dental market, ultimately achieving a two-way win-win of ‘enterprise empowering the market, and the market Achieving the enterprise’.

DYM is committed to being a trusted dental equipment brand worldwide for dentists. With 32 dental equipment production lines, 60 precision CNC machining equipment, and a 10,000-square-meter factory, it provides personalized dental equipment customization for you.